BITCOIN

-

Doomsday preppers in North America bet on bitcoin

-

Cryptocurrency is starting to impinge on gold’s appeal

Wendy McElroy is ready for most doomsday scenarios: a one-year supply of nonperishable food is stacked in a cellar at her farm in rural Ontario. Her blueprint for survival also depends upon working internet: part of her money, assuming she needs some after civilization collapses, is in bitcoin.

At first glance, it seems counter-intuitive that some of bitcoin’s most ardent proponents are people motivated by the belief that public infrastructure will collapse in times of social and political distress. Bitcoin isn’t yet widely accepted as a method of payment and steep transaction costs make it inconvenient to use at vendors that do take it.

Preppers, as it happens, have a different perspective on what they see as the money of the future, which has surged 10-fold in the past 12 months as supporters lauded it as a digital alternative to rival the dollar, euro or yen.

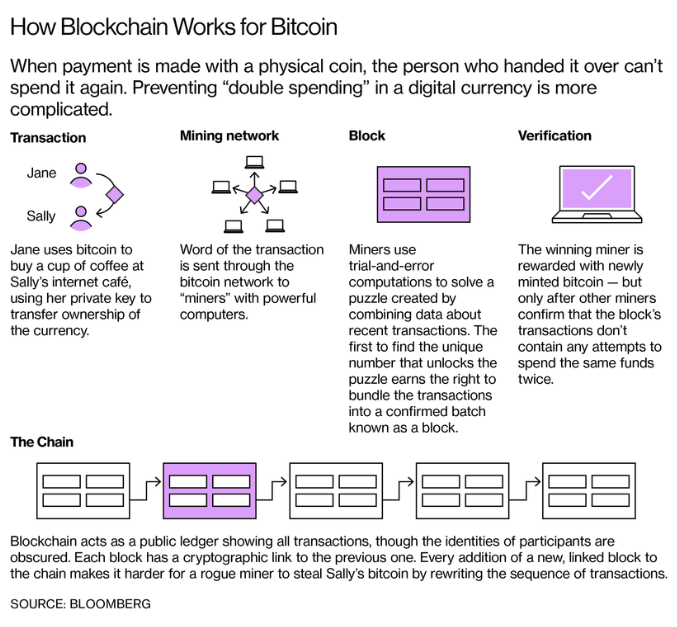

Used to send and receive payments online, bitcoin is similar to payment networks like PayPal or Mastercard, the difference being that it runs on a decentralized network—blockchain—that’s beyond the control of central banks and regulators. It was born out of an anti-establishment vision of a government-free society, a key attraction for those seeking unhindered access to their capital in case a massive shock shuts down the banking system.

“People see bitcoin prices going to the moon. No one thinks gold is going to the moon”

“Not too long ago, people in the prepper community were actively warning against crypto, and now they’re all investing in it,” said Tom Martin, a truck driver from Washington who runs a social media website for people interested in learning skills to survive the disaster. “As long as the grid stays up, people will keep using bitcoin.”

In addition to gold, silver, and stocks, Martin invests in bitcoin and peers litecoin and steem because they’re easier to travel with, harder to steal and offer better protection in the event of the kind of societal breakdown that would unfold if a fiat currency like the dollar collapsed.

He’s among those confident that bitcoin can withstand even a complete blackout through the strength of the underlying blockchain, the anonymous public bookkeeping technology that records every single bitcoin transaction.

Discussions on the pros and cons of investing in crypto have popped up on survivalist forums like mysurvivalforum.com and survivalistboards.com this year as bitcoin rallied above $7,000. “Buy bitcoin” is now a more popular search phrase than “buy gold” on Google.

The buzz is starting to impinge on gold’s role as a store of value especially since, like the precious metal, there’s a finite supply of bitcoin, which proponents say gives it anti-inflationary qualities. Sales of gold coins from the U.S. Mint slid to a decade low in the first three-quarters months of 2017.

“It’s definitely had some impact on the market,” Philip Newman, who does research on precious-metal coin sales and is one of the founders of research firm Metals Focus, said by phone from Washington. “People see bitcoin prices going to the moon. No one thinks gold is going to the moon.”

To attract investors who traditionally buy gold, several digital assets, like Royal Mint Gold and Anthem Gold, have been developed that are backed by physical gold stored in vaults.

Still, it’s hard to envision people walking around spending digital coins to buy Spam, canned beans or bottled water at a local supermarket when they don’t have electricity at home to charge their smartphones, let alone a working internet connection to access their digital wallets.

“I doubt bitcoin is a safe haven from an extreme-risk environment. In that sense, bitcoin isn’t gold,” said Charlie Morris, the London-based chief investment officer at Newscape Capital Advisors Ltd., which invests in cryptocurrencies and is building a price-discovery platform for them.

Bitcoin has also not reached the critical mass to be considered a viable currency to invest in, UBS Group AG’s Mark Haefele said in an interview. The total sum of all cryptocurrencies is “not even the size of some of the smaller currencies’’ that UBS would allocate to, he said.

Preppers, though, stock enough food and supplies to sustain them for months, if not years, and they expect whatever governing structure emerges post-calamity will prioritize getting the web back up and running.

“It may be difficult, if not impossible to access for a while, but once things start returning to some level of normality, then the blockchain will return as it was before the disaster,” said Rob Harvey, a bitcoin investor who prepares for natural and nuclear catastrophes by learning and teaching survival skills, like making a fire. “The blockchain does not need a specific place or a specific person to survive—that’s a strong survival tactic.”

“It is a people’s currency”

Interest in cryptocurrencies has started permeating the mainstream. When Morris surveyed hundreds of executives attending the London Bullion Market Association’s annual conference last month, one in 10 said they’d rather own bitcoin than gold following a nuclear war.

Along the fringe, the 20,000 libertarians expected to converge on New Hampshire as part of the Free State Project are also switching from precious metals. They like bitcoin because it isn’t created by a government, unlike conventional currency.

“You can use bitcoin for economic transactions in a way that gold was never designed to do because it’s a physical thing—it’s heavy,” Matt Philips, the project’s president, said by phone. “A lot of people don’t know what the heck to do with gold if you give it to them in exchange for a cup of coffee.”

Whatever doom-and-gloom scenario unfolds, McElroy, from Canada, has faith in bitcoin. She’s writing a book called Satoshi Revolution, inspired by the pseudonym of the person or people who created bitcoin in 2009 as an answer to the financial turmoil wrought by the global financial crisis.

She says the digital currency breaks society’s dependence on a state that uses its monopoly over the issuance of money to dominate the economy, making it a natural hedge against disaster.

“It is a people’s currency,” she writes in the book’s introduction. “Bitcoins move seamlessly through a world without states or borders, obeying only the command of individuals who choose to deal with each other. Immune to currency manipulation and inflation, they do not serve the powerful elites at the expense of average people.”

— With assistance by Dave Liedtka, and Samuel Dodge

>>> GET YOUR BITCOIN INVESTMENT IDEAS <<<

SOURCE: Bloomberg